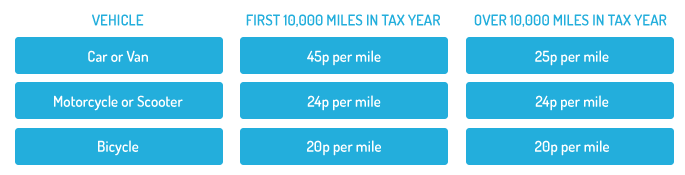

You can claim mileage when you drive between two places of work for business purposes. This means you can’t claim journeys that begin or end anywhere else, such as your home. The rates are set by HMRC and are currently:

When you calculate the miles you travelled, exclude any non work-related portions of your journey. For example, if you make a detour to grab some lunch. Please also note that your vehicle must be insured for business use.

What should I send as proof of purchase?

For your own records, please maintain a mileage log or keep copies of your expense claim confirmation emails. Fuel receipts are not required.

Examples

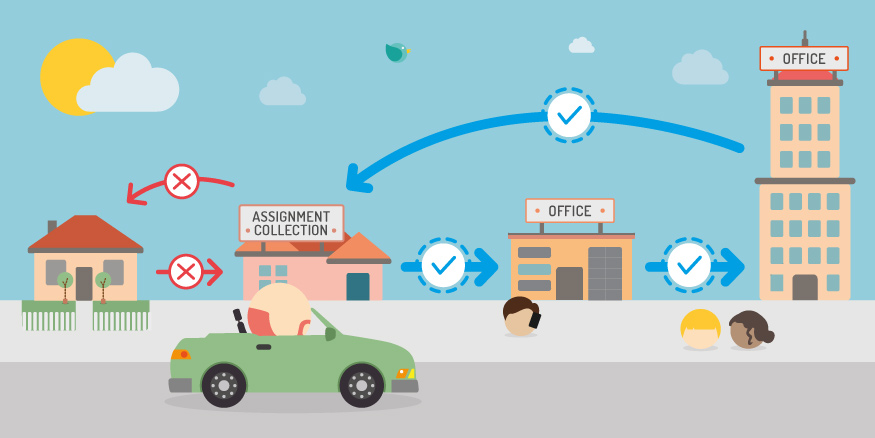

Here are some examples of journeys that can and can’t be claimed as expenses:

Example one: Kim drives from her home to her first place of work, where she spends the morning. In the afternoon, she drives over to her second place of work. At the end of the day, she drives home again. She can only claim mileage expenses for the journey between the two places of work.

Example two: Ron starts his day by driving to a central point where he collects his assignments for the day. From there, he travels to his place(s) of work then returns home via the central point. He can claim all of his mileage, except the journeys between his home and the central point.

Example three: Louise drives from home to her place of work and in the evening she drives home via the gym. She is unable to claim any mileage expenses for this day, because all of her journeys either started or ended somewhere that isn’t a place of work.